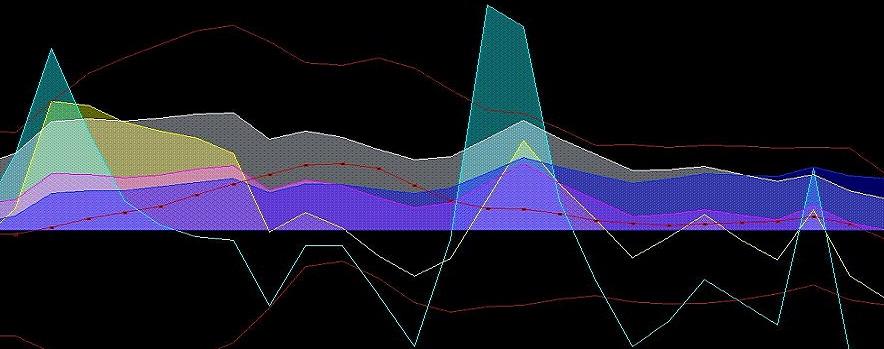

Patterns

Elliott Wave Focus / Index Insight

by Paul Strunk

Patterns, Percentages, Possibilities, Probabilities

An excellent place to begin to learn the basics of Elliott Wave can be found at StockCharts,

http://stockcharts.com

Once the basics are understood you can begin to apply the more specific rules and guidelines.

An extensive listing of the rules and guidelines I use in the application of Elliott Wave can be found in the Trading Pit Forum. Rules and guidelines for each wave in an eight wave Elliott Wave Cycle and each wave in an Elliott Wave Pattern are listed.

They are the result of years of study and applying Elliott Wave technical analysis to the stock market.

I also have listed on the education board of the forum the wave relationship ratios and statistics I use to forecast targets for the various wave lengths . These are recent developments in the application of Elliott Wave and greatly enhance the accuracy and performance when forecasting probable wave length targets.

For example a wave three can be shorter than a wave one but it only occurs 2% of the time.

Wave three will be at least 1.618 times wave one 83% of the time.

73% of the time wave two will retrace wave one between 50% and 61.8%.

Percentage of probability for wave relationship ratios of all waves are listed on the instruction board.

Of course I discuss these probabilities, rules and guidelines throughout the trading day as I apply Elliott Wave to the actual movements of the Stock Market. I post as many as ten charts through a normal day in the Trading Pit Forum. Some days there are more or less depending on the markets.

Knowing the odds of how far a wave will reach gives you a great advantage when trading.

Due to the fractal nature of the markets these same probabilities, rules and guidelines can be applied to all of the different wave degrees. So short, intermediate or long term traders can greatly profit from using Elliott Wave technical analysis.